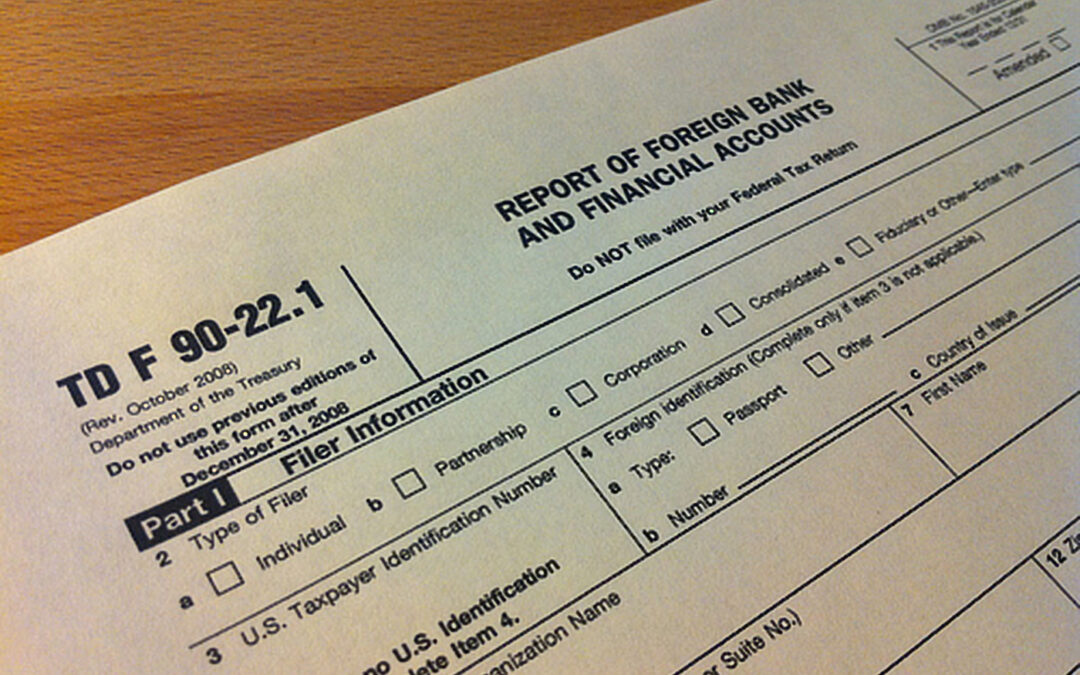

Any U.S. citizen, resident or domestic legal entity who missed the April 15 deadline to file their annual Report of Foreign Bank and Financial Accounts (FBAR) will receive an automatic extension until October 15, 2021 – and an extension need not be requested.

Who must file a FBAR?

The Bank Secrecy Act requires U.S. persons to file a FBAR if they have:

- Financial interest in, signature authority or other authority over one or more accounts, such as a bank account, brokerage account, mutual fund or other financial account in a foreign country, and

- The aggregate value of all foreign financial accounts exceeds $10,000 at any time during the calendar year.

If you possess a foreign bank account – even a small one – S&K can help you determine whether this filing requirement applies to you, and assist you in the filing process.

Penalties for not filing

Those who do not file a FBAR when required, may be subject to significant civil and criminal penalties that can result in a fine and/or prison. However, the IRS will not penalize those who properly report a foreign account on a late-filed FBAR, if the IRS determines there was a reasonable cause for filing late.

Questions or concerns about FBARs? Contact your S&K partner today to learn more!